You’ve seen it when shopping online.

That button at checkout says:

“Buy Now, Pay Later. No Interest. No Credit Check.”

Sounds like a win, right?

It can be. But it can also lead to trouble.

Let’s break down how it works—and what to watch out for.

What Is “Buy Now, Pay Later”?

Buy Now, Pay Later (BNPL) lets you split your payment into chunks.

You get the item now. You pay over time.

You may pay in four parts, spaced out every two weeks.

Or you might pay once a month for six months.

It’s kind of like a loan. But it feels easier.

And it’s right there at checkout. No forms. No waiting.

BNPL is offered by companies like:

- Klarna

- Afterpay

- Affirm

- Zip

- PayPal Pay Later

These services are popular, fast, and easy to use.

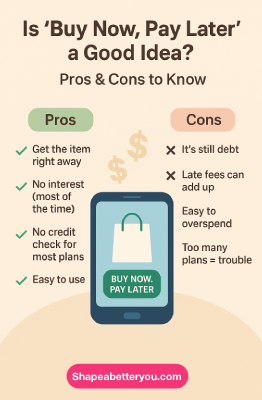

The Good Stuff (Pros)

1. You Get Stuff Right Away

No need to wait until payday.

Buy now, pay later gives you your order now. You pay later.

This can help if you need something fast—like shoes for work or a laptop for school.

2. No Interest (Most of the Time)

If you pay on time, you don’t pay extra.

Most BNPL plans have no interest at all. That’s a big win.

It’s better than putting it on a credit card and getting hit with 25% interest.

3. No Credit Check (In Many Cases)

A lot of BNPL apps don’t check your credit score.

That means more people can use them, even with bad credit.

Just know: some longer plans do check credit. And some report to credit bureaus.

4. It’s Super Easy to Use

Just click the button at checkout.

Pick your plan. Done.

No paperwork. No long wait.

The whole process takes seconds.

5. Can Be a Lifesaver in a Pinch

Short on cash but need something important?

BNPL can help you buy it now and space out the cost.

It’s better than missing work or skipping meals.

It’s also better than high-interest payday loans.

The Not-So-Great Stuff (Cons)

1. It’s Still Debt

Let’s be real: you’re still borrowing money.

BNPL may feel light and easy, but it’s still a loan.

You owe someone. And you have to pay it back.

2. Late Fees Are a Trap

If you miss a payment, many apps charge a fee.

Even if it’s just $10, those fees add up fast.

Miss more than once? Now you’re stuck in a loop.

Some companies may freeze your account or even send your debt to collections.

3. It Makes Spending Too Easy

Small payments can trick your brain.

You think, “It’s only $10 now.” Then you buy more.

Before you know it, you owe $200 across five apps.

That’s not smart spending. That’s debt building up.

4. Too Many Plans = Big Headache

If you have 3 or 4 BNPL plans going, it’s hard to keep track.

When’s the next payment due? How much do you still owe?

Forget once, and you may get a late fee.

Forget twice, and you’re in trouble.

5. It Can Hurt Your Credit

Some BNPL companies report late payments.

If you miss a few, your credit score drops.

That can hurt you later—when you want to get a car or rent an apartment.

6. No Rewards or Perks

Credit cards at least give you points or cash back.

BNPL? You get nothing.

No travel rewards. No buyer protection. Just your item and your bill.

Why So Many People Use It

BNPL is growing fast.

More stores offer it. More people click it.

Why?

- It’s simple.

- It feels safe.

- It doesn’t “feel” like debt, even though it is.

And in tough times, people just want to get what they need.

BNPL fills that gap.

But more people are starting to fall behind on payments.

That’s a red flag.

Smart Tips for Using BNPL

If you’re going to use it, use it wisely.

✅ Set Payment Reminders

Don’t rely on memory.

Use your phone’s calendar or set app alerts.

✅ Only Use It for Needs

Use BNPL for stuff you truly need.

Shoes for your kid? Fine. A new $300 sweater you saw on TikTok? Maybe not.

✅ Keep Track of All Plans

Write it down. Use a spreadsheet. Use an app.

Just make sure you know:

- What you bought

- When payments are due

- How much is left

✅ Don’t Stack Plans

Try not to use more than one or two at a time.

Multiple BNPL plans = stress.

✅ Pay On Time

Always pay on time.

Set it to auto-pay if that helps you stay on track.

✅ Read the Fine Print

Not all BNPL is the same.

Some charge interest. Some check credit. Some report to credit bureaus.

Know what you’re agreeing to before you click.

Final Thoughts

BNPL can help—but it can also hurt.

It’s easy to use and easy to overuse.

Ask yourself:

- “Do I need this?”

- “Can I afford the payments?”

- “Will I pay on time?”

If the answer is yes, go ahead.

If not, wait and save up.

BNPL is not free money. It’s a tool.

Use it right—and it won’t use you.